Chief Financial Officer (CFO) Programme (Modular)

Start Date: Afternoon, August 23, 2023

Venue: Shanghai

Participants🔸快乐10分玩法说明

The programme is tailor-made for CFOs, finance directors, and senior-level finance managers with at least 8 years of management experience, and for those who are assuming the role of a strategic partner to the CEO or other top decision-making posts in organisations. The programme will also be valuable to board members who intend to enhance their finance knowledge so as to make better decisions.

Introduction🔸快乐10分玩法说明

Along with the rapid development and continuing capital accumulation of companies, CFOs will no longer be mere chief accountants. Keeping close watch on company operations, CFOs have been engaged in strategic formulation. While dealing with financial affairs, CFOs will need to play a critical role in formulating and implementing a strategy based on their company’s operations model by assessing consistency between the financial plan and the long-term company vision and weighing benefits against risks so as to ensure a sustained growth in enterprise value. Therefore, it is imperative for CFOs to expand their scope of knowledge and build up their capabilities. The CEIBS CFO Programme is designed to reshape CFOs as CEO’s major strategic partner by equipping them with up-to-date theory and strategic thinking. The Programme covers macroeconomic analysis, financial alignment with corporate strategy, financial statements and information disclosure, taxation management, executive performance assessment, and leadership development.

Programme Coverage🔸快乐10分玩法说明

- Module 1: Financial Statements and Business Game: Changes, Challenges and Trends

- Module 2: Strategic Thinking over Executive Performance and Major Financial Trends

- Module 3: CFO’s Strong Leadership

- Module 4: Tax Management and Corporate M&As

- Module 5: Macro Economics & Financial Decisions Aligning with Corporate Strategy

A certificate of completion will be awarded.

Gain membership in the CEIBS Alumni Association. Learn More

Programme Fee🔸快乐10分玩法说明

RMB 218,000

Programme Fee includes tuition, case licensing fees, lunches, stationery, other course materials, interpretation and translation fees if required. The full fee must be paid within two weeks upon receipt of the payment notice. Applications made within 30 days of the start of a programme require immediate payment. CEIBS reserves the right to amend information on this programme including price, discount, date, location, faculty, daily schedule and other details.

Contact Us🔸快乐10分玩法说明

China Europe International Business School

Address: 699 Hongfeng Road, Pudong,

Shanghai, 201206, P.R.C.

Telephone: (86 21) 2890 5300

Mobile: (86) 139 0173 8667

Email: xtina@ceibs.edu

Faculty🔸快乐10分玩法说明

SU, XIJIA

SU, XIJIA

Programme Director

Professor Emeritus, CEIBS

Programme Co-Director of CEIBS Venture Capital Camp

Professor Fugen Mao

Professor Dawei Xia;

Programme Objective🔸快乐10分玩法说明

One of the most significant changes in the role of CFO is from process control to full engagement. The programme is designed to help participants realise the role transformation and provide them with necessary skills and effective tools.

Programme Benefits🔸快乐10分玩法说明

Participants in the programme will:

- Broaden business vision and develop strategic thinking capability

- Enhance financial analysis and planning skills

- Become a real value-creator for the company by implementing value-based management

- Help the company earn credibility, especially among investors and shareholders

- Better leverage resources to maximize financial performance

- Be able to design a proper performance measurement system for strategic implementation

- Gain membership in the CEIBS Alumni Association to participate in alumni reunion activities and keep in touch with CFO programme alumni from time to time

Programme Schedule🔸快乐10分玩法说明

Module 1: Financial Statements and Business Game: Changes, Challenges and Trends

Recent years have seen dramatic changes in financial statements in both content and format, which has significant influence on the role of CFO. Nowadays, while keeping an eye on sensitive internal financial problems where the risks and opportunities often coexist, CFOs are required to have powerful tools in hand to decode their rivals’ financial positions. With corporate accounting scandals increasing world-widely in recent years, the capital market regulators are focusing on financial disclosure and corporate governance. Therefore, CFOs should pay sufficient attention to possible influence of new relevant policies on their businesses. In addition, this module will present the essentials of the game theory in simple terms and describe its application in strategic decision-making through business cases and from the perspectives of decision sciences and psychology. It is also intended to help CFOs make a sound business decision amidst growing uncertainties in business environment. Participants will learn how to apply the game theory to probe into social phenomenon and business decision-making.

This module covers the following content:

- Evolution of accounting standards

- Accounting gray area

- Financial statement analysis

- Corporate governance

- Financial information disclosure and investor relations

- Auditing and internal control

- Decision-making amidst uncertainties in business environment

- Introduction to the game theory

- Synchronized one-shot game

- Repeated game: finitely repeated game and infinitely repeated game

- Multistage game

- Mixed Strategy Nash Equilibrium

- Infinitely repeated game

Module 2: Strategic Thinking over Executive Performance and Major Financial Trends

As the world’s second largest economy,🔸快乐10分玩法说明 has been highly integrated with global markets. Risks follow hard on the heels of Chinese companies’ move into the international arena to grab business opportunities. Given the volatile global financial market, foreign exchange risk control is indispensable for corporate risk management. In case of omission or underestimation, corporate profit may soon go up in smoke. How will the new driving force based on Internet Plus produce a disruptive or catfish effect on the financial market monopolized by traditional financial institutions? For CFOs, executive performance assessment and compensation system design has long been a hard nut to crack. This module will probe into the aforesaid issues from a strategic perspective to help CFOs efficiently exercise cost and risk control and conduct performance assessment. This module will focus on:

- Market-driven organisational design

- Organisational design and performance assessment and motivation mechanism

- Approaches to tailor-made executive compensation systems

- Corporate transition and internal innovation: Chinese-style partnership

- Performance assessment and motivation mechanism design

- Motivation mechanism design

- Criteria for performance assessment: relative or absolute

- Design of executive compensation motivation mechanism

- Chinese-style partnership: motivation mechanism for incubation and innovation

- Core functions of finance

- Chinese-style finance

- Influence of financial technology on the financial industry

- Finance for technology VS financial technology

- Reshaping finance with technology

- Foreign exchange derivatives

- Parity in international finance

- Risk identification and assessment

- Controlling foreign exchange risks in international trade and investment/financing

Module 3: CFO’s Strong Leadership

As managers of corporate strategy and the “pivots” of corporate value management, CFOs have emerged as strategic partners to CEOs. While sustaining huge pressure, CFOs need to assume multiple roles from a PR expert and statistician to a strategist and auditor. Thus, CFOs need to be equipped with not only a wealth of financial expertise, but also general management skills, particularly for communication and leadership. This module aims to explore how to motivate and guide others, build a high-performing team, and lead an organisation from a theoretical and practical perspective. This module covers the following themes: approaches to effectively managing insubordinate employees; team psychology and approaches to avoiding transient errors; team structure and approaches to awarding competition and cooperation; approaches to aligning the job structure with environmental needs; leadership development and approaches to positioning one’s leadership style and unleashing the highest potential to deliver an extraordinary performance. This module will focus on:

- Attributes of leadership

- Leadership development: self-awareness

- Thinking and skills in leadership

- Effective performance management

- Performing one’s duty VS. striving for excellence

- Managing abrasive personality

- Employee motivation

- Classical decision-making theory

- Theory for innovation and creative culture

- Team psychology and long-term performance

- Team structure and contingency theory

- Classic and modern leadership theories

Module 4: Tax Management and Corporate M&As

The global economic turbulence in recent years has posed unprecedented challenges to CFOs. Should a company establish a robust financial system to get through upheavals? Or should it grasp the opportunity to make sound investment decisions so as to achieve business growth against economic downturn? This module will cover tax management and tax risks CFOs focus on to improve their competencies in tax planning, management and risk control. The M&A theory, methodology and skills will also be introduced to participants so that they can efficiently leverage financial and financing instruments for valuation and decision-making. This module covers the following content:

- Theoretical and methodological guidance for tax planning

- Relationships between business process and taxation

- Corporate tax risk prevention

- Tax management models

- Major trends for global M&As

- Motives and risks for M&As

- Stakeholders of M&As

- M&A process and performance assessment

- Valuation in M&As

- Opportunities and pitfalls for Chinese companies’ overseas M&As

- Reverse takeover

Module 5: Macro Economics & Financial Decisions Aligning with Corporate Strategy

How should a CFO help CEO make effective strategic decisions by interpreting economic metrics, identifying economic signals, and forecasting economic trends properly so as to ensure the sustainable development of the company? Nowadays, CFOs are increasingly engaged in decision-making in terms of company business and development. While handling the company accounts, CFOs need to play their role in laying out the company’s strategic vision; when allocating assets, they need to figure out how to carry out the company strategy by aligning the financial plan with the long-term company vision and weighing benefits against risks. For this end, CFOs are required to go beyond the traditional financial and accounting mindset to get more visionary and insightful, reviewing company operations from a brand-new perspective.

- Understanding the new characteristics of global economy

- Drivers of global economy

- Trends for global economy

- Analyzing the cause of🔸快乐10分玩法说明’s rapid economic growth over the past three decades

- Analyzing the shift in the economic policy from 2012 to 2016

- Predicting the prospects for the Chinese economy

- Financial and strategic analysis

- Financial forecast

- Enabling growth and value creation through financial management

- Valuation of real options and R&D projects

- Foreign direct investment from a perspective of real options

- Real options in capital investment

- Review of financial effect of strategic decision-making

- Converting strategic choices into financial metrics

Programme video🔸快乐10分玩法说明

[video] International Balance of Payment and Future Competition in🔸快乐10分玩法说明

Note: Please make sure you have Windows Media Player installed on your computer to view the videos.Teaching Language🔸快乐10分玩法说明

Partly Chinese, partly English with sequential Chinese interpretation

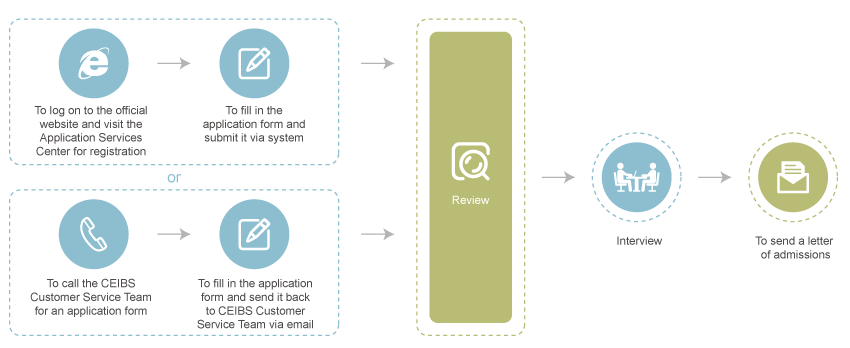

Admissions Procedures🔸快乐10分玩法说明

Applications are requested at least 30 days before the programme start date. Applications are reviewed as they arrive and admissions are subject to the final confirmation of CEIBS. Any applications received after that date will be considered on the basis of space availability. For more information, please contact our Customer Service Team in Shanghai, Beijing or Shenzhen.

Cancellations🔸快乐10分玩法说明

Any cancellation made 30 days or more prior to the programme start date is eligible for a full refund of programme fees paid. However, the expenses arising therefrom shall be for the account of the applicant or his/her employer. Any cancellation made less than 30 days prior to the programme start date shall be subject to a fee of 20 percent of the total programme fee. After the programme starts, no fees shall be refunded for participants who withdraw from the programme for any reason.

Notification🔸快乐10分玩法说明

To ensure the continuity of your learning, you are required to make proper arrangements according to the course schedule after receiving your letter of enrollment. We will neither make up lessons for you nor confer you with the certificate of completion if you are absent from the course for personal reasons. CEIBS reserves the right to amend information on this programme including price, discount, date, location, faculty, daily schedule and other details.

slide056f.jpg)